Did I say mandatory? I meant optional! You’re “free” to die in a cardboard box under a freeway as a market capitalist scarecrow warning to the other ants so they keep showing up to make us more!

Unrealized gains are the 200 push-ups Im going to do at the gym tomorrow, probably?

I know the 12 year olds will be upset but this is dumb.

Unrealized gains may never be realized. If they ever are, they may be worth less at that point than the tax you paid. It is like taxing everybody on income at the beginning of the year and then telling them tough luck if they get fired and never get that income.

Also, borrowing in assets does not make you wealthier. How much tax should we charge people when they get a mortgage ( not when they sell, when they first borrow ). I mean, somebody just gave you hundreds of thousands of dollars. Why shouldn’t you have to pay tax on that? ( according to the OP at least ).

Anyway, I will stop there. We are not going to get back at the rich by saying a bunch of stupid things. If you don’t like generational wealth, fine. Have an estate tax. If you don’t like windfall wealth, fine. Have a super high progressive tax rate. I have no problem limiting extreme wealth ( it won’t hurt me ). But “tax people I don’t like on things that make no sense” just tells people you cannot think well and are not into math.

This is both a terrible strawman of advocates for this type of tax reform and a misrepresentation of what realization events are in the US tax code.

Sure “borrowing in assets does not make you wealthier” but it does provide an excellent basis for establishing increases in wealth that have already happened. Realization is a tool to avoid arguments and uncertainty around valuation, not a requirement that taxpayers have cash in a checking account to pay their liabilities. Posting collateral for borrowing inherently involves valuation so could very easily be made a realization event, it fits very neatly into existing law.

It may be a political impossibility but your dismissal doesn’t suggest you’ve really thought about it.

Also “taxing everybody on income at the beginning of the year and then telling them tough luck if they get fired and never get that income”. As someone in a high tax bracket (and state FML) who left the country mid tax year, bless you for thinking this doesn’t happen.

Both my examples are about being taxed on money that may never exist. Your second comment makes me think you did not understand me.

I am not talking about political impossibility. And I am certainly not talking about the difficulty in calculating current market value. I am talking about the poor correlation between current value and the gains that will potentially actually be “realized”. I am talking about bad policy.

Here is an example. Back in the 2000’s, there were people that were taxed on the value of their stock options using exactly this same logic ( the “value” on paper ). Later, when the market crashed, there was not even enough value left in the shares and options to pay the taxes already owing. People literally paid well over 100% tax ( in some cases hundreds of percent ). Who were these super rich people that deserved such tax treatment? Many were relatively young employees of technology companies using equity as compensation. These employees had little wealth before being taxed on their “unrealized gains” and may have been bankrupt after. The whole concept is incredibly flawed.

I personally dislike Elon Musk. But even with him, taxing him on what he was worth at the high point would be totally unjust as he is not worth that now. It makes way more sense ( in my view ) to tax him when, and if, any of that wealth materializes. I am no fan of Donald Trump. But I think it would have been totally insane to tax him on the value of his Trump Media “wealth” when it was “valued” at $8 billion. If he gets even $1 billion out of it I will be amazed. Anyway, tax him on that. Tax it at 90% if you want. But don’t tax him on “wealth” that nobody is ever going to see.

I do not know what state you are in but I am unaware of anywhere that would tax you on “unrealized” income from your high-tax bracket salary. Nobody is taxing you on the “unrealized” benefit of your salary. Are you trying to tell me that it does? Where I am, leaving the jurisdiction for more than 6 months would render my income and gains beyond that point non-taxable so the government of course wants a “final return”. Are you talking about something similar?

Again, I am all for taxing the rich. Tax actual gains however you want. What I do not think you should do is tax “unrealized” gains. It is an incredibly flawed idea.

That wealth “materializes” when his company gets a new loan based on the paper value of his assets as collateral, even if he hasn’t materially realized that value yet. If you can get rewarded with new loans and government contracts based on paper valuations, you can pay taxes based on paper valuations.

If you can buy shit with it, it has value and can be taxed. There’s no need for playing “Schrödinger’s Gains” where the value is simultaneously worthless because it may/may not be realized yet it’s leveraged into material wealth of every kind. It’s like saying rich people don’t have money because it’s all tied up in assets, but somehow they have multiple homes, a yacht, and private jet trips. That is an incredibly disingenuous argument that completely sidesteps how wealth works.

They shouldn’t be taxed because they’re just that, unrealized. They may be worth next to nothing one day. If you use them as collateral, you’re still on the hook for the value you originally took out the loan for, regardless of the loss of the investment.

This argument applies to my wages too if I elect not to be paid in USD. Are you arguing that, say, Bitcoin income should be untaxable just because it could depreciate relative to the USD tax liability it generates.

How could you misunderstand his comment so completely?

Bitcoin is not money. You cannot file your tax return with a line-item with the number of Bitcoin you were paid. On a US tax return, you have to say how many USD you were paid. On a Canadian return, it is Canadian dollars. In the UK, it would be GBP.

If I demanded that my US employer paid me in GBP, they may do so. They would also track internally the dates they paid me, the value in USD that they paid me, and the exchange rate to GBP. The tax deducted from my check would be in USD.

This is part of the tax code in every country. You get paid in the currency of that jurisdiction ( regardless of how you choose to take payment ).

If you wanted to receive Bitcoin, it would be an investment. The taxable income would be the value on the day I received it. The value on the day that I sold is irrelevant. This is not “unrealized gains” by any stretch.

You cannot “elect” how to be paid for tax purposes. The currency on your return is a matter of law as are the rules about moving in and out of that currency. This is practically the definition of “realization”.

I don’t agree with unrealized gains taxes in general, but the instant they are used as collateral, or if value in any way is extracted from them (even loan value), they become realized gains, and should be taxed.

Wait…I pay taxes on my HELOC…

Simply tax it as if it underwent a buy/sell/trade. Capital gains and losses are accounted for in that at the time the value is utilized. They are tracked, and you don’t pay them later.

Reasonable home ownership (only home) could be exempted.

So you agree with the post then, given that that’s basically verbatim what the post is saying.

I think the key point in the post was “If ‘unrealized gains’ can buy stuff-then they’re realized. Tax them.”

Essentially, because the unrealized gains held in their stocks could be realized through a loan, all of their capital gains should be considered for taxation.

As opposed to just the assets used as collateral, that is now effectively liquid, should be taxed as realized.

I personally think we should do everything we can to disincentivize wealth hoarding, even if it’s an “unfair” or possibly somewhat broken system that does so, but it also doesn’t seem feasible as a kind of legislation you could convince anyone in the government to enact, since they’ll still be focusing on things like if it could possibly lead to a higher loss than the initial investment if they’re taxed on the gains for years, but it drops low enough to wipe out all the value they paid in tax and their gains, even if the actual price is higher than the purchase price.

Yeah, a bank isn’t going to give your a $500k mortgage on a $200k property, so if they give you a $500k loan on stock then that’s the value given to the stock at that point.

How does this actually make any sense though? All collateral is, is a safety net to mitigate loss for a lender who lends to someone who then defaults on the loan. If the loan is not defaulted on, literally nothing happens to the collateral.

How then does it make any sense to consider the mere act of the loan being given as a realization of the collateral, in other words, equivalent to having sold the collateral, when literally nothing has happened to it?

This feels completely arbitrary. Using an asset as collateral is nothing like realizing it.

Realization is the establishment of value not sale for cash (it just happens that the most convenient establishment of value for any non-fungible asset is sale). There are already some realization events that don’t have associated cash flows, to do with overseas assets or certain financial instruments. Ordinary people don’t need to worry about this stuff, it’s not for them, and if you’re rich you can trivially figure out the cash flow issue.

But capital gains avoiding tax for the life of a wealthy person who lives off collateral zed borrowing, then being stepped up in basis for their heirs is just embarrassing for the US.

And WHAT gain exactly is being taxed? So you have a $1000 investment. The government decides, what, that you are a good investor and can make 20% so they’ll tax you on $200? So if you sell it at a loss, you get screwed. If you sell it for a 50% gain the government loses tax revenue? You know what, I’ll take that deal. I’ll invest money, pay the taxes on my unknown gain immediately, keep it for 20 years and boom, tax free, because I’ve already paid the taxes on the gain. You know I’m totally on board with this whole rich people suck idea, but this is just stupid.

I don’t agree with unrealized gains taxes in general, but the instant they are used as collateral, or if value in any way is extracted from them (even loan value), they become realized gains, and should be taxed.

What you’re suggesting would also mean you’re advocating for middle class homeowners to be taxed on a full value of a Home Equity Line of Credit (HELOC) even if they haven’t spent a dime of it yet. Was that your intention?

They didn’t set out their whole tax platform for their presidential bid friend. We can trivially blow down your straw man with a primary residence exemption or, you know, tax brackets.

Homeowners are excluded from capital gains tax for the first 250k for individual filers.

I believe you’re referring to rules on sale of a home where there is a capital gain, meaning you bought the house for $100k and sell it for $350k, no cap gains taxes. We’re in uncharted waters with what @[email protected] is proposing. That user (possibly) suggesting it for HELOCs too.

Okay but you can just apply the same logic to a HELOC. If you get a 30k HELOC for a bedroom renovation then it does not count towards capital gains tax.

Even normal capital gains taxes have brackets.

Okay but you can just apply the same logic to a HELOC. If you get a 30k HELOC for a bedroom renovation then it does not count towards capital gains tax.

Wouldn’t this be a double standard if we’re applying @[email protected] 's logic? The rich would get taxed on loaned money but the middle class wouldn’t?

That’s generally how progressive tax brackets work, yes. Technically speaking if I rich person wants to take out a 30k HELOC they’d also not get taxed on it.

This is how… EVERYTHING works… Income tax brackets, 401k limits. I thought this was pretty obvious, from each according their ability and all.

deleted by creator

The top 10% own 67% of the wealth in the U.S.

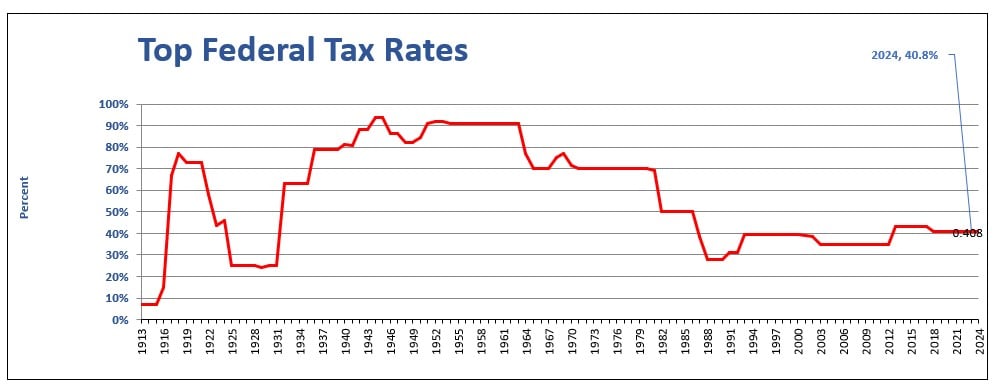

The tax rate during the New Deal (which corresponded with the largest jump in GDP and middle class growth) on people earning $200k and over (now would be like earning $2.5 million/year) was 95%.

During the 50’s through the early 80’s, that tax on the wealthiest was at 70%.

Now it’s at 37%, less than half of what it was during the best years of growth our country ever experienced.

This Unrealized gains tax would only impact people worth more than $100 million who do not pay at least a 25% tax rate on their income.

Additionally, you’d only pay taxes on unrealized capital gains if at least 80% of your wealth is in tradeable assets (i.e., not shares of private startups or real estate). One caveat is that there would be a deferred tax of up to 10% on unrealized capital gains upon exit.

In short, it would not apply to most startup founders or investors, but would impact top hedge fund managers.

They can afford it. TAX THEM.

Anyone seriously talking about the 95% rate can be safely ignored as a liar by omission.

The amount of stuff you could deduct was very different back then. Nobody actually paid 95%, regardless of what the law literally said.

There is a reason this person is not showing you per capita tax revenue over the same time period.

I’m curious, could you provided these numbers?

Ummm I didn’t know they could be used as collateral. I’ll have to research that. It doesn’t sound right to me for the same reason they definitely should NOT be taxed. How does that even work? You buy stocks and you hold them, then, what the government taxes you every year until there ARE no gains. Or perhaps the stock plummeted and you have a loss, but it’s ok, you lost money on the investment AND to the government. Until you sell an investment you haven’t made any money on it and it should NOT be taxed. If you have a 401k this would affect you too, not just rich people.

Ultra net worth individuals, especially ones like Jeff Bezos with a lot of his net worth tied up in one company, can take a personal loan using his stock as collateral to keep up his lifestyle without needing to sell (and be taxed on) anything. It’s only really available for the 1%

Anyone can buy stocks in a margin account and then borrow against it as margin, and use that margin to make more money. If you can open a brokerage account, you can do this.

Shit can turn on you real fast though and you can lose a lot of money since you’re borrowing against the value of a fluctuating asset.

E.g $1000 stocks let’s you buy $400 on margin, but if that $1000 becomes worth less than $700 you gotta pay back that $400, but now you gotta sell at $700 or pony up more cash and that $400 you bought is also only worth $200, so you sell $200 of your $700 and suddenly you’ve lost 50% of the value

I’ve never made 6 figures before, but was asked to show my investment portfolio value when applying for a mortgage as it was part of my assets. Assets the bank could seize if I didn’t pay my bill.

TIL I’m the 1%.

The poster you’re replying to is talking about something else. There’s a point where the terms you can get for loans using your stock portfolio as collateral are so good that you can count on your stock value growing faster than interest payments on the loan, enabling you to take out loans that amount to free money and live off of them (or use them on more investments that grow faster allowing you to take larger loans, etc).

Banks don’t mind because they reliably get their interest payments, can count on settling the account when the person dies, and of course there’s the social capital of being the institution that ultra wealthy people bank with. For an ultra-rich person it’s how they can have the liquidity to live an ultra-rich lifestyle even if all of their wealth is tied up in the market.

I still think anyone can do that, just on a smaller scale. Either way, sounds risky. Stocks sometimes go down as it turns out.

That’s strange. I’ve had a few mortgages now and have never been asked to show my investment portfolio. Where are you and what bank asked for the info?

Canada. All of the banks I applied at asked for total assets, including TD and Scotiabank.

TIL I can use my stock as collateral in a mortgage

They can be used as collateral because they are assets that have value. You can use your car or house as collateral too, and neither requires payment of federal income tax.

There isn’t a federal tax on most assets. It’s income that’s taxed. If your assets gain value they can be sold, at which point you pay taxes on that income, though often at a reduced rate (e.g. Capital Gains Tax for selling stock at a profit).

Except most state/local governments do have property taxes on houses, land, and cars. Not unrealistic to apply the same towards other assets. Specially since taxing homes and cars is counterintuitive because you’re taxing necessities, while taxing monetary/investment assets like stocks would make more sense to encourage more spending instead of just hoarding the money.

Most states don’t tax cars outside of sales tax.

They may have registration, but that’s different than tax and only applies of you use the vehicle on public land.

Property tax is usually school districts and municipalities, and is well-under 1% most planned.

And you can do the same thing. He got a loan using his stock as collateral. The stock has value. The bank can use that value to issue the loan as they see fit within federal regulations. They can do the same with your less than $100m portfolio.

How about we just make things fair so that the ultra rich pay their share? This is not the way. It literally makes no sense.

It’s how billionaires can buy things while allowing their sycophantic boot licking fanboys to cry “their wealth isn’t liquid!” anytime anyone proposes common sense tax reform.

This isn’t common sense. It’s stupid. Please explain how it works.

It’s simple, if you’re a billionaire prepare to get soaked

That sounds like a very compelling argument.

Haha ty. But in seriousness, I do think there is a level of wealth that one can attain that becomes political.

Like civil servants, attorneys, judges, healthcare workers, etc, are held to different standards and subject to different rules (same laws ofc), because of the power they may wield over others.

Oligarchs individually can affect the lives of millions of people. That’s the kind of power we put checks on.

Absolutely, but that’s not what we’re talking about. We’re talking about creating a tax on an unknown number that will apply to a lot of not rich people. And then taxing it again later for I -don’t-know-how-many times.

How about instead, we make a flat tax and remove loop holes in or any number of ways that apply across the board.

I don’t have a problem with people wanting to be rich or even being rich. I have a problem with how they get there and what they do when they get there. It’s completely unfair and oppressive, crushing people who dare stand in the way, forced labour, buying politicians, etc. I’m sorry but I’m not a communist. Just arbitrarily deciding anything a rich person does should be illegal because a rich person does it is just silly.

There has to be hedging requirements right? If you have 100 million of growth stocks for example, surely you’d need to have put option contracts for that loaning insitution to accept the risk of unrealized assets to secure a loan of that size?

Anyone know how that works? Im sure each loan is reviewed thoroughly for its risk at that level.

Put options are a specific investment vehicle. The OP is just making a blanket statement about unrealized gains. Many, many NOT rich people have unrealized gains. And there literally is NO value to tax. The investment could go bust and there is a loss, no gain at all. At what point in a long term investment is the tax assessed?

But the point of a put contract would be to lock in the strike price for a duration determined by the expiration date. If put contracts were purchased for the duration of the loan, the potential risk of being unable to pay the bank due to depreciation would be mitigated.

Like how farmers buy puts on their commodity to protect themselves from a bad year.

It costs money to buy a put contract to protect the loan.

So if you need a 1mil loan, now you also gotta buy puts that’ll protect a downturn of 1mil. So now you gotta sell stock which will be taxed. It’s less than 1mil so you’re taxed less, but you will have taxes.

Edit: you could zero cost collar (puts + covered calls) your investment to protect it’s current value, but you’ll give up potential gains as well to get the zero cost part. But this would be a way to protect the value without selling. If the options get exercised though, you’d then have some taxes to pay.

I’d say, when it is used as a vehicle for any financial transaction. If an employee exercising stock options pre-IPO has to pay tax on something that they are unable to get any financial value out of for at least 6-12 months, there is no legitimate reason that unrealized gains used as collateral should not be taxed. It’s just another way to shift tax burden onto people who actually work.

Ok. How much tax do they pay? And later when that stock quadruples and they sell, do they pay again or get a free ride for the extra it’s gone up because they’ve already paid? How many times to they get taxed on it?

I’m not ultra rich, but I have stocks that I’ve been purchasing for decades. I’ll be damned if it’s fair that I be taxed on a stock for a company that may go out of business before I ever see any profit. Why do we even assume it will go up? How about we assume it goes down and I get to write that off my taxes now and sort it out later if the assumption is wrong.

You’re literally trying to tax people on an imaginary number.

Except they are using it as collateral to accumulate excessive amounts of wealth, essentially replacing their income, tax free.

Which is why the first commenter mentioned the tax should be used on unrealized gains that are used as collateral. Not just the unrealized gains themselves.

Also, yea, when they sell, they pay a tax. Just like everyone else. That is a completely separate instance of wealth accumulation that is unrelated to the wealth accumulated by using those gains as collateral.

Don’t like it? Don’t buy stock and earn your money through income from a job instead. It’s that simple.

Though tbh I think this entire discussion on share and stock is pointless. Profit paid to shareholders is wage that should have been paid to a worker; if you don’t perform labor for that company, you shouldn’t have any entitlement to the profits made from that company.

Serious question - who here is in favor of taxing unrealized gains and has more than $20k in personal investments? (Outside of retirement/401k or other tax advantaged accounts)

“The law, in its majestic equality, forbids the rich as well as the poor to sleep under bridges, to beg in the streets, and to steal bread”

-Anatole France

I’m sure the status quo is just dandy to the 10% of Americans that owns 87% of American stocks, and especially the 1% that owns 50%.

The beneficiaries of societal privilege, which

earningmaking money without labor is, will always view anything that makes society more equitable as oppression. This is like seeking out the opinion of business owners on Jim Crow laws in the 50s. You’re just looking to confirm your own biases.I chose the number because it is attainable to the median household with 2 years of saving 20% of their after tax income, but also substantial enough to feel the burden of risk associated with investing. Stocks are not guaranteed income, they are not money for nothing, and changing the playing field affects a lot of regular people just trying their best to build a reasonable amount of wealth, whether to buy a house or secure their financial stability.

I am not close to being a top 10% wealtholder, nor am I related to anyone who is, and I certainly was not expecting to have my investment question compared to complicity in mass racial segregation.

Why does it feel like you pretend people with less than a billion dollars or something in that order of magnitude’s neighborhood in unrealized gains would ever be affected by this legislation?

Laws like these should never affect you unless you’re one of like (I’m guessing numbers) 15 people in your country, so I don’t understand the issue people so often have with them. From my point of view, if we don’t change anything to combat wealth inequality, the most likely outcome is civil unrest (esp. with more climate disasters looming on the horizon)… genuine question, please don’t take it with hostility – I would just like to understand “the other side” here: why would you personally oppose this?

P.S. about to hit 6 (euro)figures invested. ≈50/50 stock/ETF split. But I’m not sure if that truly counts toward your opening question since it’s basically the place for my long-term savings money, but there’s no such thing as regulation for a tax-advantaged “retirement investing” (401k etc.) account here, yet 🙃

We have defunded schools without enough teachers, school supplies, etc because the wealthy use the inane amount of capital they hoard to buy local government to cut their taxes. Then they set up Charter school escape hatches for some kids that they then profit from from publicly traded charter management companies. Those kids did nothing to deserve being caught up in their greed disease.

We have economic segregation from the cradle. That’s no fucking better. Making more money should let you have a bigger car/house/TV/widgets, but we let some make so much that they use it as a cudgel to extract more from us to our detriment. Fuck their employee’s kids, theirs goes to a private school so starve the commons your company operates on but doesn’t want to pay for.

But believe the dream all you like. Not like there’s hope since we’re literally terraforming the planet against being hospitable to our very physically vulnerable species for millions of years.

This is legitimately the dumbest argument. You will just dismiss any commenters who disagree with you (“that’s your opinion, donate it to the government!”).

Besides, there are literal billionaires who will actually be affected by this clamoring for it. No one who has less than $100 million will be affected. No I don’t need a history lesson about income tax. If you want to live in a country without taxes, Somalia will welcome you.

P.S.: I have more than $20K in personal investments.

Would a home count as unrealized gains? Because I’d be fucked if I got taxed on it more than I already do.

You probably do get taxed on it ( property tax? ). However I agree that taxing you on the “unrealized gains” from your home would be insane.

Think of how many seniors with a fixed income would be out on the street if this was to happen. Little old ladies in houses they bought decades before. Tax codes often defer even property taxes for seniors as they recognize that these people do not have actual “wealth” outside of these illiquid assets.

Of course, those houses will eventually be sold. If you want to collect more tax, increase the amount of tax you collect on those actual gains.

Yup, but I don’t see how taking away everyone’s rights is going to help that situation. That’s the way it is. People seem to think only ultra rich people have unrealized gains. I’m sorry, b but it makes no sense to tax an unknown number.

Lol. You are ignoring the fact that we already tax unrealized gains: property tax. And that’s actually harder to value than something on a stock market.

An “unknown number”? When you open your Robinhood app, does it show numbers? Because if it doesn’t I think you need to message their help desk.

The only proposals are for massive gains above $100 million. I think a 1% tax on that would be just fine.

LOL. I don’t agree with property tax based on home values either.

What part of the stocks in a portfolio that you have not sold have no gain aren’t you getting? Yes, there’s a number in Robinhoid and tomorrow that number could be zero. Companies go bankrupt and when that happens, common stock goes to zero. Until you SELL the stock, there IS NO gain or loss.

The OP does not mention only gains over $100m.

The answer isn’t to tax them. It’s to not allow them to be used as collateral.

Sure that perfectly works because salaries are so high, I don’t need any other form of income at all. I’ll just forego any other investments because some rich guy might use them. Seriously, this is your solution? You do know it’s THAT rich guy that sets your salary, right?

You do know it’s THAT rich guy that sets your salary, right?

Which is why they need to be reigned in in a hundred different ways including this one, to force…any… responsibility to the society that FACILITATED their accumulation of such ridiculous levels of wealth to begin with, from roads, to utilities, to the preliterate workforce Pool they utilize and tear up for private profit more than normal individuals but don’t want to pay for.

Unfortunately, the self-hating laborers that would waste their lives advocating we get comfortable attempting to satiate the insatiable greed of our oligarchs in perpetuity seem to keep forgetting their greed disease has us on an ever dwindling clock to ecological collapse/apocalypse, meaning no salaries, just death. As much as you may not want it to for the sake of your passive income

earnedmade without actual labor, this capitalist laborer hostage situation for basic survival will end, because the climate can’t be bribed, negotiated with, bought out, cut in, or outsourced.No one solution can solve the problem of our greed class, and the top economic 10% of Americans own 87% of American stocks, so your attempt to frame this as an everyman issue is hollow.

When we have conditionless housing available to everyone without shelter, when everyone has Healthcare, when no one goes to sleep hungry without enough to eat, then we can start talking about what people with asset portfolios are concerned about.

Maybe society should focus on getting Bezos’s support mega yacht a support support mega yacht instead though.

Oh brother. Talking about a high horse.

So if you tax unrealized gains, the rich will still be rich but everyone else will simply stop investing. They will have no option but to only earn money from the rich guy. Oh but we’ll all have collectives because everyone who works wants to be an owner. And the best way to make any decision is to have a whole bunch of people provide input.

Look I’m all for eliminating the unfair rules that allow people to become billionaires. This rule is not one of them. And I’m sorry, but there are millions of people in the US with 401k retirement plans and they all have unrealized gains. They would all be effected. So don’t pretend this is ONLY a rich person thing. This isn’t a tax on the rich. It’s a tax on trying to become rich.

We should tax extreme wealth into oblivion, with a 100% congratulations you won capitalism tax at some point so they can’t collect enough wealth to start warping politics beyond their single vote.

No one should be able to live like modern pharoahs in a finite world with finite resources where others die of lack of resources.

Or, how about we just tax everyone equally and keep them from making the rules. Make a little money, pay a little money. Make a lot of money, pay a lot of money. As far as I’m concerned, if you can make a billion dollars on a level playing field, more power to you. Now pay up.

Because capital is an expression of power beyond material needs/wants, and even government can’t effectively govern a class of people that have enough capital to bribe officials en masse to literally bend the laws and regulations to their wills, including to make their bribery perfectly legal as they succeeded in doing here.

That’s why fiscal conservatives were so aroused by the idea of making government, the government that is supposed to protect the citizenry from the whims of those with more power, “small enough to drown in the bathtub.” They succeeded. Our government is subservient to Wall Street’s dictates because we let a few citizens accumulate enough, and shrunk government oversight enough, to turn it into just another acquisition to manipulate to maximize short term private profit.

The reason this is a conflict is that if profits are not managed democratically (as in a worker’s cooperative), then they will be extracted as profits for a small oligopoly (the owners) who can choose by their whim who gets a piece of that profit.

Very often that’s buddies in their back-scratching kickback network, with a smattering of highly productive workers.

So with a 401k loan, which is kind of this, you are limited to borrowing against it by like only up to 50% of its face value due to factors such as market volatility. And then all payments made to that loan are with alreaey taxed income, so you aren’t securing money in any way that dodges taxation.

Also using shareholdings is no different from using a house or property as collateral… property equity has unrealized value until it is sold too. One might argue you pay property taxes on that equity, but ideally, the company behind the stocks you own pays property taxes for its ownings annually, so that’s still happening. So the real problem is large companies dodging taxes due to exploiting broken tax code loopholes.

You can’t use a 401k as collateral for a loan.

Also, i think income tax is double taxation. Businesses are the key market players in an economy so why not orient all taxation around them? Do away with personal income tax and property tax. Keep/increase sales tax, luxury tax, sin tax. And clamp the largest salary in a company to be allowed no more than 20x the average salary in the company to address wage disparities. If the CEO deserves a 1 mil bonus, the average employee deserves at least a 50k bonus. Also, no worker’s rate can be paid less than 1/20th the salary than the average employee. The more spread out the dollars are, the better it is for the economy.

That’s how the rich get richer. They never gamble with their own money. They gamble with other people’s money, secured (hah) by their assets.

Yes a minority of us peons who are privileged enough to own property or lots of stocks can play-act like they’re rich by taking out reverse mortgages or doing options trading, but it’s nothing like what the actual rich can get away with.

I think a law stating you can’t borrow against unrealized gains would be sensible.

You can keep your unrealized gains forever, live of your dividends for all i care, and pay no tax. But realizing them, either through selling or borrowing against, triggers a taxation.

This.

deleted by creator

Are dividends taxed?

“Yes*”

*As with all rules, it can vary by country. As I understand it, the US tends to double tax dividends, which is a rabbit hole of why the US market chases valuation so hard

Dividends paid out to taxable accounts are taxed.

Dividends that pay into non-taxable accounts can accumulate until they are withdrawn.

So, for instance, if you own $100 of Exxon in a regular brokerage account and $100 in an IRA, the $5 dividend you get from the first account is taxable but the $5 from the second is not.

This gets us to the idea of Trusts, Hedge Funds, and other tax-deferred vehicles. If you give $100 to a Hedge fund and it buys a stock in the fund that pays dividends, it never pays you the dividend on the stock so you never have to realize the dividend gain. You simply own “$100 worth of Citadel Investments” which becomes “$105 worth of Citadel Investments” when the dividend arrives.

I think dividends in a tax-exempt accounts, like a traditional IRA, are only not taxed if you reinvest the dividend or just leave it in your brokerage account. If you move money from your IRA account to, say, your checking account, that’s when you pay taxes (and there are generally fees for moving money out of tax exempt accounts without meeting certain conditions, like being of retirement age).

I think dividends in a tax-exempt accounts, like a traditional IRA, are only not taxed if you reinvest the dividend or just leave it in your brokerage account.

Right. Although, with a ROTH IRA, you pay taxes before you put the money in. Then you earn tax free even after you take it out. That makes it the preferable vehicle for long-term savings (you should expect your initial investment to double every 10 years, assuming a 7% ROI which is fairly modest - so over 30-40 years you’re saving 8x on the eventual withdrawal).

But this isn’t just limited to IRAs. Using investment funds, you can pull the same trick. Buy the fund, then allow the broker to shuffle the investments within the fund as they please. You only “earn” the money when you exit the fund, in the same way you only “earn” your retirement when you withdraw from your IRA.

Savings accounts and trusts can then be structured to be inheritable tax-free, with your heirs having access to withdraw from the fund without ever actually owning the money (and thus needing to pay taxes on the inheritance). And to make it even more squirrelly, you can borrow against these funds, which allows you to make large purchases without ever actually spending any money. This maneuver, plus a cagey use of declared loses, means you can avoid paying any tax on any investment income virtually indefinitely.

There is a big maybe on whether Roth is better than traditional IRA/401k.

My kids are at the age where they are making those bets now. So I made a hugely complicated forecasting tool to forecast which would be better.

I think it really comes down to your view on future tax rates.

Your mileage may vary.

I think it really comes down to your view on future tax rates.

Unless you’re banking on a 0% tax, the ROTH is hard to beat. Compound that by the Traditional IRA being taxed at the normal rate rather than the capital gains rate, and there’s very little reason to use it unless you’re really bullish on tax cuts in the long term.

I largely agree with all the points made here however I think the overall message is a bit misleading. I would disagree that Roth investments are the preferred for long term investments. You aren’t accounting for the opportunity cost of the taxes paid in the initial investment year. Those taxes, while small compared to what you will withdraw tax free are also losing out on 8x-ing themselves (as you would have invested that amount in a traditional tax advantaged account).

What this means is Roth is the preferable savings method if you are in a lower marginal tax rate than you expect to be in retirement. However traditional is better if you are in a higher marginal rate than you expect to be in retirement. If the marginal tax rate was the same when you invest and retire then the difference between Roth and traditional would be nil.

You aren’t accounting for the opportunity cost of the taxes paid in the initial investment year.

If you’re maxing out your contributions, it won’t matter, except in so far as what you can earn on taxed income outside of the IRA account. That’s going to be marginal relative to the contribution. And the compound returns inside the IRA make it meaningless.

What this means is Roth is the preferable savings method if you are in a lower marginal tax rate than you expect to be in retirement.

Unless you’re going straight into a white shoe law firm or extraordinary paying tech job after you graduate, that’s pretty much everyone. But even folks going into Fortune 500 companies typically start in the $60-80k/year range and climb up from there.

If the marginal tax rate was the same when you invest and retire then the difference between Roth and traditional would be nil.

The amount of money you have in the fund is going to be much larger.

Say I invest $5000/year up front and get a 10% return for 40 years. I’m looking at putting in $200,000 over that time and taking out $2.2M.

Assuming the tax rate is 25% for each of those years, I paid $50k in taxes to invest that initial $200k. But I get the $2.2M back tax-free.

If I put the $200k in tax-deferred, I have to pay $550k to get my balance out again.

Now, we can argue that I could put the $400/year in deferred taxes into a taxable savings account. And maybe we get clever by shielding that investment from taxation annually because we just shove it all in Microsoft or Berkshire B and let it ride. That nets me another $177k over 40 years, assuming the same rate of return (for which I’m still on the hook at 15% long term gains rate - so really only $150k).

The ROTH is $350k better. That’s the whole reason the fund exists. It’s another accounting gimmick to give wealthy people a stealth tax cut. Only suckers put their money in Trad IRAs.

Thanks for expanding on the finer points! With inheritance, they also reset the cost-basis when the owner dies, which means that all the capital gains accumulated over the time that the deceased had ownership is never taxed. Like, if I bought stock for $10, die when it’s worth $100, my sister inherits it, and then sells it for $110 a while later, she only pays capital gains on $10 – not $100.

I don’t think people fully realize how dramatically our tax code rewards capital, at the expense of labor, not just in the broad-strokes (like the tax rate for capital gains vs the rates for income tax brakets) but also in these little details that are easy to overlook. So thanks for the discussion!

Yes

Not sure if it’s the same everywhere, but if I pull a dividend I don’t pay tax initially, but when I do my income taxes it’s part of my income and I’d have to pay tax on it then

Careful with that. If you’re not making estimated tax payments on your dividends (or other capital gains) every quarter or increasing your withholdings from wages to compensate, and you owe too much at the end of the year, you can get hit with penalties and interest.

For most people the quarterly dividends in their brokerage aren’t enough to trigger that, but as your savings grows and quarterly dividends become significant they might.

Where I’m from, we don’t do that. All dividends come with an “imputation credit,” which basically says “this money’s already been taxed.”

Mhm. There’s two very good reason unrealized gains aren’t taxed: volatility and cash flow. Are you and the government expected to swap cash back and forth everyday to correct for changes in the market? No that’s silly. Should people go into debt because they don’t have the cash to pay the taxes of a baseball card they happen to own that is suddenly worth millions? Also silly.

For that same reason, using unrealized gains as security is dangerous, just like the subprime loans market was!

There’s a precise moment in time you take a loan. Use that moment in time to calculate worth; tax.

if you secure debt against them, they should be taxed?

Yeah owning a baseball card worth money sure whatever, if you pawn that card sorry, pay taxes. You use that card a to secure a loan with lower interest rates than you’d get without then sorry, you are realizing gains whether or not you want to admit it. This goes along one of the lawsuits against Trump. He lied to get favorable interest rates by overvaluing his assets to get better interest rates. If that’s against the law why the fuck is that not counted as a “gain” to use assets to secure favorable interest rates?

We’re talking about the stock market. And it would be quarterly or annual. Please stop exaggerating.

There’s a very good reason they should be taxed; half a dozen people are richer than god, and basically never pay any real amount of tax.

This would effectively lock out every small investor from the stock market due to the liability of both success and failure.

I mean the stock market is literally gambling, so the risk of success and failure is already there. The proposal is whether or not we should allow people to use unrealized gains to secure loans without having to pay taxes on said gains at the point of taking the loan. This would only occur if you’re worth more than 100 million. You can afford to pay that tax.

I mean the stock market is literally gambling

I’ve a better record of success than the most successful poker players. Is it ten years of good luck or the consequences of effort and skill?

The proposal is whether or not we should allow people to use unrealized gains to secure loans without having to pay taxes on said gains at the point of taking the loan.

Thus locking out all non-corporate investors from margin, prerequisite to options, prerequisite to risk mitigation and gains enhancement. The average investor looses the freedom to do much more than DCA a fund.

This would only occur if you’re worth more than 100 million.

-

It’ll never be passed in such a way. Legislation always favors the corporate and wealthy as they’re the ones that write it. It’s most perverse in finance and investment. There’s been nothing favoring human investors since the breakup of Ma Bell.

-

It’s totally inadequate to save the republic from the nearly-unmitigated, algorithmically-optimized capitalism that exists today. The biggest fish, corporations, would simply get bigger by eating their biggest threat: humans with a lot of resources, but not the most affluent.

The stock market is a tool. It’s not the cause.

TL;DR:

The neolib’s proposal is crap.

This isn’t:

-

legislate away most of corporate personhood

-

restore the Glass-Steagall Act

-

repeal the Interstate Banking and Branching Efficiency Act

In no part of your response did you make any sense or a rational point, demonstrating a clear lack of understanding and a wanton disregard for good-faith arguing. Troll gonna troll I guess.

I can’t dumb it down any more. Perhaps another can do so.

-

No it wouldn’t. The proposal out there right now has a floor of something like a million dollars. Most of us will never need to worry about that.

How so?

“Oh no, I made money, better put a small percentage of my gains away for tax season, just like I do with all of my income, because I’m American and lack a good PAYE system”.

deleted by creator

Someone here has made a false assumption. In fact, I’m pretty sure we both have made several. The question is who has made a fatal false assumption? Let’s go.

My root comment, at the top of all of this, was my idea that perhaps we should consider gains “realized” when they are sold OR used as a collateral in a loan.

Your assertion is that it would wipe out small investors.

I would question how many small investors are using their small investments as collateral in a loan?

deleted by creator

Good

Or doing so, it counts the loan as income and is taxed accordingly. But seriously, the main aim itself can also be taxed. A house is…

You’d have to put some controls in there for that solution to work. Hitting new homeowners with an immediate tax on “earning” $1,000,000 to pay for their house seems a bit cruel.

The unrealized gains is for 100 millionaires or more. I don’t think there is anyone with 100million in unrealized home value.

I was talking for a hypothetical world where that law isn’t a thing and simply paying capital gains in “realized” gains is.

Nut hey, yeah, sure, 100mil works too.

Wouldn’t that affect things like Home Equity loans?

Homes are taxed based on assessed value. They are already a form of taxing unrealized gains.

Most of the population either has:

- no unrealized gains

- gains in a retirement account that we can’t borrow against

- gains in real estate that are taxed, but can be borrowed against

- a combo of 2 and 3

I think it’s fair to ask that the rich play by the same rules. You can either borrow against your gains and pay taxes on them, or not pay taxes and not be able to borrow against them.

No because the mínimum for this to apply is 100 million.

The government also told the public that the income tax was going to apply only to rich people, how’d that turn out?

Depends on the exact implementation, but sure, you could happily write a version where an initial home loan isn’t hit, and only “top up” loans against the INCREASED value of your home is targeted.

That was my thoughts as well.

How are you going to enforce that? The Bank can cite whatever they want for giving the loan.

If we just tax them then it’s easily enforceable and it’s done.

It can just be flipped on it’s head;

How are you going to enforce taxing on value, the person can just cite whatever value they want for the asset.

No they actually can’t. In stocks the price is publicly listed by a third party. In real estate an assessor gets involved. For commodities like cars they have to be unique or nearly so before there isn’t a third party listing it’s value.

For edge cases, especially large real estate, we could always make a second law, one that says the government can buy your building at the value you gave the IRS if it’s significantly below market rate on dollars per square foot for it’s type (office, industrial, residential, etc), or that it’s represented as a higher value in investment reports or bank loans. We’ll frame it as a bail out, helping them offload toxic assets. Then the government sells the building on the open market. That way when someone like Trump decides his buildings are suddenly worth less than all of the surrounding buildings we can keep him from going bankrupt again.

https://www.propublica.org/article/trump-fraud-ruling-property-valuation-michael-cohen

A former sitting president has been indicted, if not convicted of this very crime. You’ll have to excuse me if I don’t believe it’s that uncommon.

It took literal decades and the magnifying glass of running for public office. I’m not comfortable with that being the standard.

It is the standard. Now. Currently.

If you don’t like it, might I suggest a guillotine or several. Worked for the French.

Or, we could pass a law changing that standard.

Seems more reasonable than taxing unrealized gains, although I’d prefer if the debate was on how to cut absurd amount of spending rather than trying to find new tax streams.

I’d rather we went back to taxing the rich properly and stopped having crumbling infrastructure.

You’re “free” to die in a cardboard box under a freeway

Actually… They made that illegal. You’re free to rot in prison for being homeless, though!

If it’s one homeless guy dieing under the bridge it’s a capitalist scarecrow sothat other people work harder.

If it’s a hundred homeless guys dieing under bridges the people understand that the problem is not them, but capitalism. That’s illegal.

Capitalist Scarecrow is such an effective term. It feels like enshittification in the way that I see it everywhere, and now I finally have a word for it.

edit: wording

Sitting here, watching every town council around my area pass a homeless ban after that SCOTUS ruling. Even the newspaper suddenly switched and said popular opinion swung 180 degrees in the last six months.

What the fuck does one do at that point? It’s obviously manufactured consent. It’s blatantly unconstitutional to tell people they can’t exist on public land. It’s a human rights violation to be stuffed into a shelter that demands you be a better human than people who already have housing in order to get house money. At this point we’re just turning the homeless into the new scary minority.

The goal is extermination and genocide. There is nowhere for the homeless to go except into the ground as dead bones, where they won’t bother the privileged and rich anymore.

I don’t know if we’re there, but that’s definitely one way Automation has been theorized to go.

Three hots and a cot is better than nothing…

Well then there’s the forced labor.

Yeah, unfortunately.

Yea this is a bad idea. All this will do is force small investors-think people that have made maybe a million dollars in their life and are retiring at 70-to pay taxes they don’t have cash to pay.

The Harris proposal kicks in at 100 million dollars lol if you have over 100 million dollars in unrealized gains you are not a small investor and should pay your taxes.

most people don’t understand how tax brackets work

Yeah and most people like to pretend someday they could have that much money too, not realizing it’s strictly generational and they’d already have it.

Like how the Revenue Act of 1913 only applied the new “income tax” to $3000/year ($90k/year in today’s dollars) and up.

? Sure yeah ?

And just like how federal income tax rates have been and are adjusted constantly over the years due to inflation since 1913, it’s safe to assume these tax brackets will be updated also

The Harris proposal kicks in at 100 million dollars lol

The snark is uncalled for, this tweet doesn’t mention any proposal specifically, so don’t act like they’re saying something incorrect.

I think the real solution is not to lend on fake money. Tax or no tax, it wasn’t taxes that caused the market crash in 2008.

Then good luck getting a house mortgage because you can’t lend based on future income because it’s not guaranteed. When I bought my house they incorporated the value of my brokerage account. I wouldn’t be able to own a place if they didn’t.

With house mortgages it’s collateralized against the house, a physical object, but it has only a fake value until it’s actually sold because house prices can go up or down.

Thank you. Even if they pass something it will be written by a bureaucratic bean counter and will be riddled with loopholes.

Simply don’t allow loans on stocks. Keep it simple.

deleted by creator

Ok but then you’ll pay taxes on that sale so there’s no problem.

That’s only for you humans. We corporations only pay if we net a profit. Also, if we loose money, we can carry it over to next year as a tax exemption. Good luck, ugly bags of mostly water.

Eh so… If you lose money you also can carry the tax rebate over to the next year in the US…

deleted by creator

Yes, humans as well.

Same as companies, just a different maximum amount per year and what’s left can be applied to the next year and the next and the next…

That doesn’t work. It’s not enforceable.

Not enforceable as a law, but not bailing out those who do it is a great way to put an end to it.

I’d rather just have it done than give them another thing they can pressure politicians to bail them out of later.

All money is fake money, though.

The real money is the friends we made along the way who owe us favors.