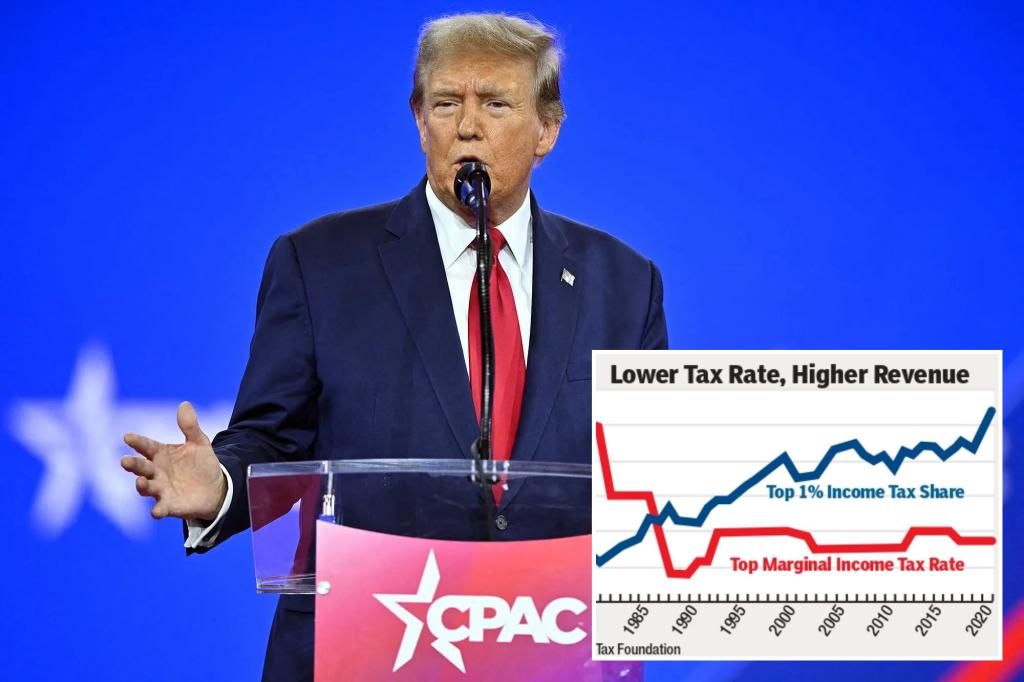

The latest IRS data on who bears the income tax burden demonstrate yet again the benefits of lower tax rates over higher rates.

When President Donald Trump entered office, the richest 1% of tax filers ($675,000 income and above) paid a little more than 40% of the income taxes collected.

The 2017 Trump tax cut reduced the effective highest federal tax rate to 37% from 42%.

But the most recent IRS tax return data (for 2021) confirm that even as these rates were lowered — not to mention the corporate tax rate cut from 35% to 21% — the share of the tax burden shouldered by the 1% rose to almost 46%.

Written by the guy who came up with the Laffer Curve, Arthur Laffer.

Easy enough to understand with simple ratios. If the top 1% holds 50% of the nation’s wealth, we would expect they should pay somewhere around 50% of the nation’s taxes. If their wealth increases to 60% you would expect the amount of taxes they pay to go up by a relatively equal amount.

Conversely the lower 99% would pay an inverse proportion of taxes. If the wealthy are becoming propositionally more wealthy, the less wealthy should be paying less of the nation’s taxes.

Now, that doesn’t necessarily mean that someone in the 99% will actually pay less taxes, as their wealth is not increasing at the rate of the 1%. It just means that the wealthy should be paying more as their proportion of the nation’s wealth keeps growing.

Your 1% has 50% of the wealth stat has been telephoned to what you’re parroting now. The original stat is the 1% has more wealth than the bottom 50% combined. This stat stopped being used because it got exposed for being misleading. The bottom 20% has negative wealth and it’s not until the 35% - 40% that there is positive combined wealth. A single person in the 21st percentile has more wealth than the bottom 40% combined. What that stat is really saying is the 1% have more wealth than the combined wealth of people between 40% - 50%.

I was making up numbers as an example, but seems the more accurate estimate is the top 10% hold 66% of the nation’s wealth.

Except we don’t tax wealth. We tax income. Taxing wealthy is unconstitutional.

The high income earners pay more than their percentage of earnings. As such they pay their fair share.

https://taxfoundation.org/research/all/federal/rich-pay-their-fair-share-of-taxes/

As you will see, high income earner pay much more.